Savings accounts are an excellent solution for consumers with a specific need. They let you designate funds away from your checking account to organize your finances and retain clear sight of your goal. They also can serve as an emergency fund when unexpected bills arise.

Unfortunately, most savings accounts offer little return and make it hard to rationalize moving money from your checking account. However, A high-yield savings account ensures your money earns interest from a safe and secure location without the risk of fluctuating markets.

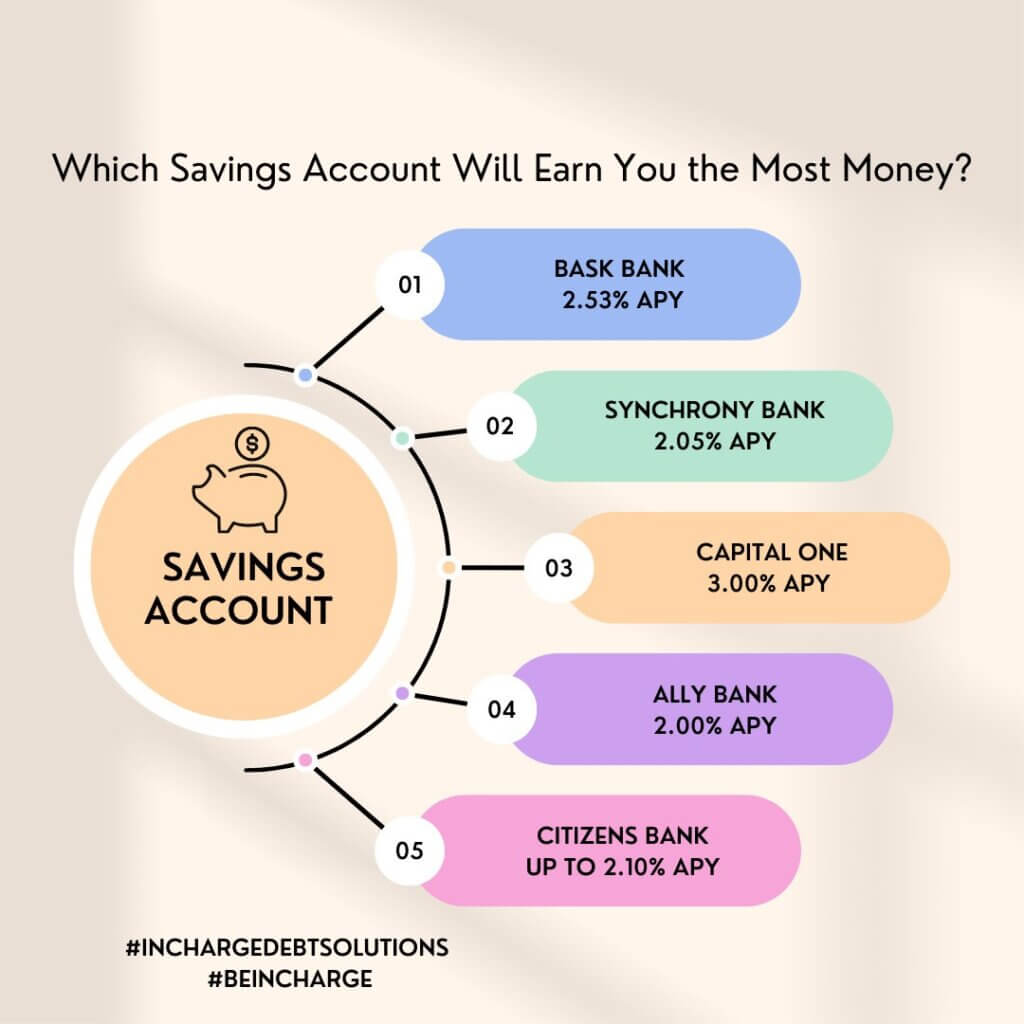

Here are some of the most rewarding high-yield savings accounts available to consumers.

» Learn More: Advantages and Disadvantages of High-Yield Savings Account

Bask Bank – 4.25% APY

Bask is a division of Texas Capital Bank, an established FDIC-insured bank based in Dallas, TX. It offers an enticing 4.25% APY, while insuring the sum of your deposits for up to $250,000.

You will need your name, contact info, and SSN to open a Bask bank account. You will also have to answer some security questions to verify your identity. You may link external bank accounts via bask. With no debit or ATM card offerings, the easiest way to access your funds is by sending an ACH transfer to your account at another bank. You can withdraw from your available balance at any time.

Bask Bank Features

New Customers can make up to six online transfers per month for a maximum total of $50,000. Established Customers can make up to six online transfers per month for a maximum total of $300,000. Transfers can take 1 to 3 business days to process.

Bask bank has no monthly account fee. However, it charges a transaction fee for wires and protects your information with multiple layers of security aligned to industry standards, such as Advanced Encryption Standard (AES). There is no minimum amount needed to open an account. However, if an account remains unfunded for 30 days, Bask reserves the right to close that account.

Bask does not offer joint-ownership accounts, but you can include up to five beneficiaries on your individual savings account. Bask also offers a mileage account where consumers can earn travel rewards. You can have one Bask Mileage Savings Account and up to five Bask Interest Savings Accounts. You can transfer funds between these accounts.

Synchrony Bank – 3.75% APY

Synchrony is a financial services company operating over 80 million active accounts. Its consumer finance business is the largest issuer of private label credit cards in the U.S.

With no physical branches, Synchrony saves on the expense of maintaining brick-n-mortar locations and passes those savings on to consumers by offering competitive rates of up to 3.75% APY. Your rate is variable and subject to change at any time. Also keep in mind that interest is compounded daily and credited monthly.

To open a high-yield savings account with Synchrony, you’ll need to have a valid U.S residence and Social Security number or Tax Identification number.

You will also provide your address, occupation, employer, and source of funds to open the account. This helps Synchrony comply with federal law and combat money laundering and other suspicious activity.

Synchrony Bank Features

Synchrony offers an optional ATM card you can use to pull money from your savings account at any ATM displaying the Plus or Accel logos – whether stateside or abroad.

While Synchrony doesn’t charge ATM fees, one may be due to the ATM owner/operator. Synchrony will refund up to $5 in ATM fees per payment cycle. Diamond status and Perks Reward members have unlimited ATM access without fees. However, Synchrony will not refund conversion or access fees charged by ATMs overseas.

Connect up to five external accounts to your Synchrony account. You can do this online, via the app, or over the phone. It generally takes around three business days for a transfer from an external account to process. Synchrony charges $25 to send a wire transfer. However, they are free to receive.

Synchrony Bank is a member of the FDIC, insuring your deposit accounts for up to $250,000 per ownership category. The maximum total balance limit of all your accounts is $3,000,000. Synchrony Savings accounts don’t require a minimum balance. However, you risk account closure after 60 days of a $0 balance.

Ally Bank – 3.40% APY

With an Ally account, you can earn up to 3.40% APY on your savings. Ally uses information from your accounts to provide insights about your money, spending habits, and goals. The online bank offers some exciting features to help consumers stay on a frugal track and achieve long-term financial success.

Ally Features

Buckets: Can organize your savings accounts into different categories. These are not individual accounts. You can create up to 10 buckets while still earning interest on the account’s total balance.

Boosters: Can help automate savings, swiftly achieving financial benchmarks and milestones.

Recurring transfers: Automatically set transfers between accounts to stay on track of savings goals without constantly reminding yourself to put away funds.

Surprise savings: Using advanced analytics, Ally will identify any extra money in your linked checking account (based on your spending behavior) and transfer it to your online savings account. Ally will only initiate Surprise Savings on Mondays, Wednesdays, and Fridays, and never more than $100 at a time. You can stop Surprise Savings at any time.

Round-ups: This rounds up to the nearest dollar transactions you make with your checking account. Once the rounded-up amount reaches $5, Ally makes a transfer to your savings account.

Citizens Bank – Up to 3.75% APY

Citizens offers access to a sprawling network of over 1,000 branches and over 3,000 ATMs. It provides 24/7 fraud monitoring and FDIC insurance to ensure account security. Apply for an account with Citizens online, over the phone, or at any Citizens branch.

Citizens offers three choices for high-yield savings accounts.

- One Deposit Savings: Basic option and an excellent complement to your checking account.

- Citizens Quest Savings: Offers unlimited ATM transactions.

- Citizens Wealth Savings: Up to $10 in non-Citizens ATM fee refunds per statement cycle.

With a savings account from Citizens, you can earn up to 3.75% APY. Below we’ve detailed some unique features that make Citizens an excellent option for consumers focused on getting the most out of their savings.

Citizens Features

Citizens Checkup: Schedule an appointment with a Citizens banker for a more detailed summary of your accounts.

- Free for all Citizens customers.

- Bankers will assess and develop a customized approach to your needs.

- Help you start or modify your financial journey.

- Help you track for retirement and more.

- Appointments are available in branch or by phone.

Automated Transfers: Set weekly, bi-weekly, or monthly transfers to ease the pressure of remembering to put away regular savings.

Savings Goal Calculator: Calculate how much potential savings you miss out on each month.

With a Citizens account, consumers can get paid up to two days early when they sign up for direct deposit. Early access to your hard-earned cash can help overcome the stress of overdrafts and upcoming bills to pay.

6 MINUTE READ

Home » InCharge Blog »

Sources:

- N.A. (ND) About Bask. Retrieved from https://www.baskbank.com/faq

- N.A. (ND) Help Center. Retrieved from https://www.ally.com/help/bank/savings-money-market.html

- N.A. (ND) FAQ. Retrieved from https://www.synchronybank.com/banking-resources/faq/?UISCode=0000000

- N.A. (ND) Welcome to Citizens. Retrieved from https://www.citizensbank.com/apps/personaldeposits/legal/Personal_Fees.pdf