Staff Writer

Joey Johnston

Joey Johnston has more than 30 years of experience as a journalist with the Tampa Tribune and St. Petersburg Times. He has won a dozen national writing awards and his work has appeared in the New York Times, Washington Post, Sports Illustrated and People Magazine. He started writing for InCharge Debt Solutions in 2016.

Income-Driven Student Loan Debt Relief

If you have student loan debt, you have plenty of company. More than 43 million Americans had a total of ...

Arkansas Resident Debt Relief

The average resident of Arkansas has a credit card debt of $4,791. This is lower than the national average of ...

Idaho Resident Debt Relief

At least one economic predictor thinks Idahoans could be on the path toward brighter days ahead. Idaho has the nation’s ...

Maine Resident Debt Relief

Maine has a reputation for resilience – thank the rugged weather and geography that has taught Mainers what it takes ...

New Hampshire Resident Debt Relief

New Hampshire’s state motto, emblazoned on its license plates is “Live Free or Die,” and Granite Staters take pride in ...

What to do When You Can’t Afford Rent

Most people have to pay for housing. In fact, it’s probably one of the biggest, if not the biggest, bill ...

How I Raised My Credit Score 200 Points in a Year

When Jeromy Arroyo was growing up, there was a subject “that was pretty much off limits at home and school,” ...

Paying off $50,000 in Credit Card Debt

Running up $50,000 in credit card debt is not impossible. About two million Americans do it every year. Paying off ...

New Mexico Debt Relief Programs & Resources

New Mexico Credit & Debt Consolidation Information The people of New Mexico are among the national leaders in a financial ...

West Virginia Debt Relief Programs & Resources

West Virginia Credit & Debt Consolidation Information One of the most basic tenets of good financial sense is figuring out ...

North Carolina Debt Relief Programs & Resources

Being the 20th most visited state in the U.S, North Carolina knows how to keep people coming. The birthplace of ...

Nevada Debt Relief Programs & Resources

Nevada Credit & Debt Consolidation Information While Nevada is predominantly known throughout America for the glitz and glamor of Las ...

Thank You

Success! A bankruptcy specialist will be reaching out to you soon. If you need immediate assistance, call (866) 736-7920.

Judgment Proof

Judgment Proof Please fill in the form below and submit the data to start processing. Convenience We listen to what's ...

Iowa Debt Relief Programs & Resources

Iowa Credit & Debt Consolidation Information Iowans have the reputation for being the tough and hard-working types able to weather ...

Kansas Debt Relief Programs & Resources

Kansas Credit & Debt Consolidation Information Credit cards let you spend more money than you have. This makes them useful, ...

Missouri Debt Relief Programs & Resources

Missouri Credit & Debt Consolidation Information Like most states, Missouri has been shaken by the Covid-19 pandemic. According to Truth ...

Virginia Debt Relief Programs and Financial Assistance Resources

If you’re a Virginia resident facing credit card debt, InCharge Debt Solutions is here to lend a hand. We provide ...

Oregon Debt Relief Programs & Resources

In recent decades, Oregon had successfully made the transition from an economy based on resources, like timber, to a more ...

Washington Debt Relief Programs & Resources

Washington Credit & Debt Consolidation Information Washington state residents historically have less credit card debt than the national average, but ...

Indiana Debt Relief Programs & Resources

If you’re an Indiana resident dealing with credit card debt, we’re here to help. InCharge provides free credit counseling to ...

Best Ways to Start Saving for College

Saving for college is likely on the financial priority list for those who have (or plan to have) children, but ...

Budgeting for a Baby

Whoever said children are priceless clearly never had any. Raising a baby born in 2023 to the age of 18 ...

What Is a Balance Transfer Credit Card?

Feeling frustrated and overwhelmed by credit-card debt? You aren’t alone. According to a Bankrate survey, 30% of American households have ...

Debt Consolidation Loans: How To Consolidate Your Debt

About Consolidating Your Debt With A Loan If you have trouble making ends meet, if your stack of monthly bills is ...

Unemployment and Credit Card Debt

Choose Your Debt Amount Consolidate Debt in Minutes Home » Archives for Joey Johnston Handling Credit Card Debt While Unemployed ...

How to Save Money on Internet: Free and Low Cost Broadband

Free Internet You can qualify for a $50 free internet benefit from the federal government if you meet the following ...

What Happens During a Credit Counseling Session?

Millions of Americans living paycheck to paycheck are familiar with that sinking feeling of being unable to get out of ...

Car Expenses: What’s Included & How To Save

Cars are a necessity. Without one, most people couldn’t hold a job, buy groceries or shuttle kids to school. But ...

How To Save on Your Car Insurance Premiums

You drive a modest vehicle. You are safe on the road, always obeying traffic signals, staying within the speed limit, ...

10 Ways to Save Money on Rent Payments

If you’ve been in the market for an apartment or rental home, you know how deep you have to dig ...

Getting a Mortgage After Bankruptcy

Bankruptcy doesn’t have to put an end to your dream of owning a home – it could happen as early ...

Rebuilding Your Credit After Bankruptcy

If your debts have been discharged through bankruptcy and you are employed, you should have room in your monthly budget ...

Understanding Bankruptcy

"I need a second chance!" That is bankruptcy in a nutshell. For whatever reason, your finances have gone sour, you're ...

Getting a Mortgage While in a Debt Management Program

As rosy as the housing market appears, aspiring home buyers still face obstacles. Far too many people misuse credit cards ...

How to Cancel a Debt Management Program & Remove An Account

Two common questions consumers have when considering a debt management program are: Can I cancel my debt management plan? Can ...

What Kinds of Debts Can a Debt Management Plan Help With?

Debt management programs are designed primarily to assist consumers with high-interest credit card debt, but also could include any form ...

How Much Does A Debt Management Program Cost?

Debt management program fees provide the money needed to operate the nonprofit credit counseling agencies that provide this service to ...

How to Enroll in the InCharge Debt Management Program

If you are thinking about enrolling in a debt management plan to get control over your credit card debt, here’s what ...

Getting a Loan on a Debt Management Program

The purpose of a debt management program is to eliminate credit card debt and teach consumers how to manage their money. ...

Online Debt Consolidation

What Is Online Debt Consolidation? Consumers who want to consolidate debt, can expedite the process by using online tools to ...

Finding a Reputable Credit Counselor

Credit counseling is a vastly under-tapped resource for people crippled by debt. A credit counselor’s goal is to educate consumers ...

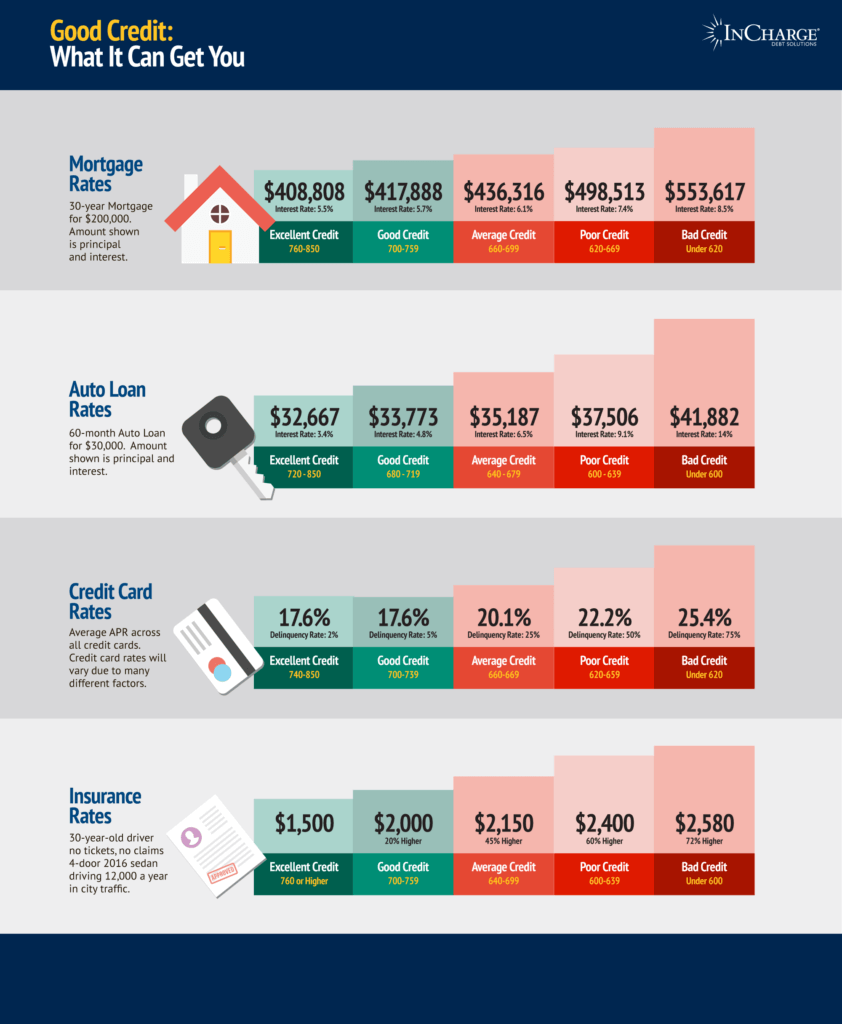

Benefits of Good Credit & What You Can Do With It

Your credit, good or bad, can have an impact on almost every aspect of your life, from having a roof ...

Credit Repair for Mortgage Approval

Finding the perfect home is still the American dream, but finding someone willing to lend you the money for it, ...

Fair Credit Reporting Act: Common Violations and Your Rights

A consumer’s financial future can rise and fall on what’s in their credit report so keeping a close eye on the contents ...

How Multiple Credit Inquiries Affect Your Credit Score

Do you panic whenever a lender or landlord proposes pulling your credit report? If so, a lot of that anxiety ...

My Mom Stole My Identity: What to Do When a Parent Steals Your Identity

Think most identity thieves are distant, shadowy online hackers? The truth is that your mom could steal your identity. Your ...

How to Avoid Credit Repair and Credit Counseling Scams

There are two terms that consumers with blemished credit reports should be careful with: credit repair and credit counseling. Credit ...

How to Increase Credit Score

Credit Repair Alternative: Credit Report Education & Action Plan If you knew that you could improve your financial health today, ...

How Mike Bell Paid Off $18,000 in Credit Card Debt

Mike Bell has been through some battles in his life – literally and figuratively –and he just won one that’s ...

Military and Veteran Debt Relief

Five Military Debt Relief Programs Members of the military have plenty to worry about when they are serving our country. ...

Bankruptcy Alternatives

Federal and state laws provide bankruptcy as a remedy for unmanageable debt, but the price you pay to clear away ...

Should You Choose Debt Settlement or Credit Counseling?

You’ve tried it all – eating Raman noodles twice a day, creating a budget, cutting your cable TV – but ...

How Do You Get Your Annual Credit Report?

Everybody makes mistakes. That goes for governments, banks and even the credit bureaus overseeing your credit reports. You can spot ...

Debt Management vs. Debt Settlement

The one constant in the U.S. economy over the last six years is debt. It keeps going up … and ...

Online Credit Counseling

Nowadays, we do everything online. We pay the bills, shop for groceries, and order Chinese food without leaving the comfort ...

Should You Consolidate Business Debts?

Business loans are terrific for turning expansion dreams into reality or paying expenses in a lull, but they can also ...

The Debt Avalanche Payoff Method

If you’re swamped in debt and it’s harder each month to at least pay your minimum credit card balances, inaction ...

How to Consolidate & Refinance Student Loans

If you are a recent college graduate, chances are you’re still struggling to wrap your head around the student loan ...

How Tina and Eddie Paid Off $24,000 in Credit Card Debt

Everyone knows that debt is an unacceptable subject in polite circles, especially if you’re the one not paying the bills. ...

How Michele Conquered $7,000 in Credit Card Debt

Imagine the commotion in a household with five children ages four through 23, run by a single parent who is ...

Getting Reorganized: Chapter 11 Bankruptcy

Chapter 11 bankruptcy does for businesses what Chapter 13 does for individuals in terms of buying time to reorganize in ...

Top 5 Budget Apps

Budgeting has a straightforward rule: spend less than you earn. Sure, it's a lot easier said than done, but it's ...

Statute of Limitations on Debt Collection by State

The “Statute of Limitations” for credit card debt is a law limiting the amount of time lenders and collection agencies have to ...

Debt a Big Problem for Marriages

What are the most devastating words spoken in a marriage? (Multiple choice): A) “I’m seeing someone else.” B) “I totaled ...

From Medical Emergency to Debt Free: How I Paid Off My Debt

Ryan Nokes was a teenager when his parents gave him his first credit card with this very stern warning: "This ...

Renting with Bad Credit

Yes, it is possible to rent an apartment with bad credit, and there are ways to boost your appeal as ...

Does a Short Sale Affect Your Credit Score?

Short sale or foreclosure? Short sale … or foreclosure? What should I do? That was the unhappy decision a lot ...

Finding Financial Help for Domestic Violence Victims

Domestic violence, as experts are learning and victims have known for a long time, goes way beyond simply “violence.” It ...

Financial Help for Senior Citizens

About Senior Citizens Debt Relief Where have the years gone? Nearly every 60-something person has wondered and worried about the ...

Pre-file Credit Counseling

Take our pre-file credit counseling course to receive a certificate of completion in compliance with the Bankruptcy Code. Start Pre-file ...

Pre-Discharge Bankruptcy Education

Start Pre-Discharge Course Now Home » Archives for Joey Johnston About Pre-Discharge Education Bankruptcy petitioners all have one goal: getting ...

Credit Counseling vs Bankruptcy

Bankruptcy and credit counseling both can be used to fight crippling debt and often they work together to resolve your problems. Laws demand ...

Low Interest Debt Consolidation Loans

Debt consolidation is a common “get-out-of-trouble” solution for troubled consumers, especially those with overwhelming credit card debt. You take out ...

How Debt Is Split in Divorce: Credit Card, Mortgage, Auto & Medical

Splitting assets is a priority for married couples, but what happens with debt during a divorce is just as important, ...

Opening a Free Savings Account With No Minimum Balance

A common question among young people just getting started with "adulting," or others trying to battle their way back from ...

How to Set and Achieve Financial Goals

If you want to buy a new car or climb Mt. Everest or retire to a yacht, there’s one sure ...

Should You Be Investing While You Are In Debt?

The stock market is setting records every week, which creates a real temptation for people in debt. Every time you ...

Create a Special Valentine’s Day on a Budget

Love makes people do foolish things. Nothing is more foolish than going into debt for Valentine's Day. We're not anti-love. ...

Your Personal Finance Calendar for 2025

Resolution: 2025 is the year you’ll get financially organized, day by day. You know the drill this time of year. ...

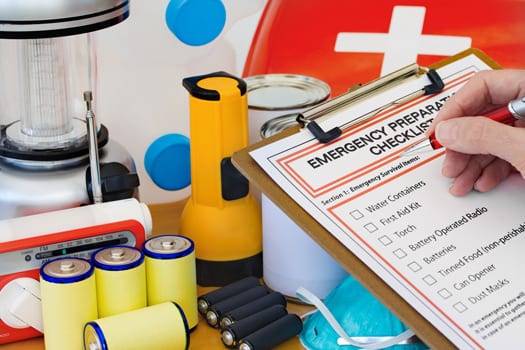

Make Sure Your Family Has a Disaster Plan

June 1 marks the beginning of hurricane season. Meanwhile, across much of the Western U.S., major droughts have greatly increased ...

Should I Pay Credit Cards or Tax Debt?

The choice between paying credit card debt and taxes isn’t as simple as calculating money saved on interest. Failing to ...

Finding a New Job After 50

Getting laid off is traumatic, but at least I got the bad news in a fitting place. I was in ...

How to Pay Off Debt by Making More Money

One of the best ways to get out of credit card debt is the old-fashioned way – earn more money. ...

Retired and in Debt: Help for Senior Citizens

Debt is a growing threat to the retirement plans of Americans. In fact, the only time most retirees will be ...

How I Got Into and Out of $45,000 in Credit Card Debt

Walter was one of millions of Americans financially swept under during the Great Recession a decade ago. Before the downturn, ...

Debt Management Myths: What You Need to Know

Debt management plans might be the most productive and least appreciated member in the family of debt-relief solutions that includes debt ...

Top 5 Retirement Roadblocks and How to Clear Them

A disturbing number of Americans are speeding toward a financial cliff called retirement. Unless they change their saving habits, they ...

How to Be Prepared If You Lose Your Job

Getting a pink slip might not be as devastating as learning you have a serious medical problem, but the trauma ...

Dating and Debt

Is carrying a lot of debt worse than carrying a lot of weight? If you’re a millennial the shocking answer ...

The 3 Reasons For Wage Stagnation: Globalization, Temp Work and Automation

If you want a raise in 2018, please don’t hold your breath. You might not make it to 2019. More ...

How’s Your Financial Health? CFPB Survey Says America Needs Work.

So you want to avoid financial problems in 2018? Fear not, Uncle Sam is on the case. The Consumer Financial ...

Holiday Budgeting and Spending Tips for a Debt-Free Season

If you’re still paying off the bills from last year’s holiday merriment and wondering how you’re going to afford anything ...

Tips for Dealing with the Equifax Security Breach

The recent security breach at the Equifax credit reporting agency exposed a gold mine of personal information on 143 million ...

No Raise Coming: Why You’re Not Getting a Salary Increase this Year

Warning! No Raise Coming for Most of Us There is plenty of advice out there on how to get a ...

Student Loan Debt a Curse on Millennial Generation

It’s not easy being a Millennial. They get ridiculed more than Donald Trump, though at least Johnny Depp hasn’t threatened ...

Store Credit Cards Not Consumer’s Best Friend

Everyone knows the pitch. You’ve spent half an hour trying on clothes off the rack at a shopping mall department ...

The Current State of Financial Literacy in America: Be Afraid

We are a nation of financial dunces. For proof, try answering this question. Why should want to improve your credit ...

I Can’t Pay My Car Insurance: How to Save on Your Premium

If you’re having a hard time finding affordable auto insurance, here’s some strange-but-true advice to solve the problem: Move and/or ...

How Do You Consolidate Your Bills?

The first step in consolidating your bills is calculating how much debt you have and how much income is available ...

How Do I Pay Off My High Interest Credit Card Debt?

Credit card debt can be especially burdensome when the cards carry high interest rates. Compounding interest can create a snowball ...

What to do When You Can’t Pay Your Income Taxes: A 3-Step Plan

It’s the least wonderful time of the year for millions of cash-strapped Americans thanks to three letters – I-R-S! Income ...

Don’t Pay College Tuition with a Credit Card

As a strategy, paying for college with a credit card sounds enticing. Your card probably offers generous air miles or ...

Kick-Start Your Emergency Fund with Your Tax Return

One morning, the sound of raindrops wakes you up and your first thought is “Not another rainy day! And your ...

How Long do Negative Marks Stay on a Credit Report?

Generally speaking, negative marks remain on your credit report for seven years, though Chapter 7 bankruptcy stays on for 10 ...

Good Credit vs Bad Credit: How to Tell The Difference

Kenny Rogers is a singer, not a debt management adviser, but if you want financial security, take his famous words ...

How to Find the Best Mortgage for You

Finding the right home loan – and a credible lender willing to offer it – isn’t easy. Since the Great ...

Social Security Increases Maximum Taxable Earnings for 2017

The government just gave a raise to a lot of Americans who really need one. Now they just have to ...

Retirement Account Changes in 2017

After a year of political upheaval and economic uncertainty, it might come as a relief that 2017 holds few surprises ...

How to Live in a Big City and Not Go Broke

Eddie Hall wanted to become an actor. So where did he go? Where else? After high school, he left his ...

Health Savings Accounts: Is a FSA Or an HSA Right for You?

Saving for medical bills isn’t nearly as fun as putting money aside for a trip to Disney World or a ...

When to Give Your Kids a Debit Card

More than one-third of college students say managing a bank account is a major cause of stress. Also, 12% say ...

How to Save Money on Childcare Costs

Sara Greenwood works at a bank. Her husband travels frequently for his job. Their parents live in different states. The ...

Generation X Has the Most Credit Card Debt

Gen Xers, the most neglected generational group in America, lugs around the most credit card debt. If you’re involved in ...

Should You Pay Off Your Mortgage Early: Pros, Cons & Early Pay-Off Tips

Paying off a home is a large part of the American dream — if any of us ever actually get ...

How to Survive Open Enrollment and Save Money on Health Insurance Premiums

As companies approach the “open enrollment” period for employees choosing health insurance, it pays to research benefit options and read ...

How to Get a Small Personal Loan: Fees, Term and What to Avoid

Central air conditioners always die when you need them most. Rebecca discovered that on 100-degree afternoon last July. Without warning, ...

First-Time Homebuyer Mistakes You Want to Avoid

Stacie Samuels wants a do-over as a first-time home buyer. Samuels, a nurse practitioner from St. Petersburg, believed she was ...

Why ATM Fees Are Rising and How to Avoid Them

Standing outside an ATM at two in the morning, Thomas Knapp couldn’t help but hear his economics professor’s words ringing ...

New Rules for Prepaid Cards: CFPB Calls For Transparency

The soaring popularity of prepaid cards will be put to the test over the next year as providers adjust to ...

Why a Great Credit Score Doesn’t Indicate Financial Health

Credit scores are like plastic surgery. They can make you look good, but good credit does not necessarily mean you’re ...

How to Teach Children Good Financial Habits: CFPB Releases Building Blocks

Laura Adams, known nationally as the “Money Girl,’’ is a personal finance expert, a best-selling author and the creator of ...

Six Credit Card Myths Debunked

Ric Edelman, a financial adviser who is a best-selling author and syndicated radio show host, remembers the days when everyone ...

Your Personal Financial Calendar for 2017

Have you ever wondered, as you peered enviously over the hedge at the neighbor’s place, whether that shiny Beemer in ...

Money Secrets and Lack of Planning Harm Retirement Dreams

By all accounts, David and Margie Stapleton did an admirable job reaching their financial goals before retirement. They have a ...

How a Clinton or Trump Presidency Will Impact Your Finances

This might bore you, but the following story on the presidential election does not address beauty queens, philandering husbands or ...

FINRA Study Shows Growth In Financial Capability

Nearly one-third of American consumers find it easier to pay their bills, have more opportunities to save money for the ...

How to Stop Enabling Financially Irresponsible Family Members

Dealing with the Financially Irresponsible Giving financial help to a family member – especially if it’s yet another cash payment ...

Sources:

- Butler, D. (2020, May 5) Historical S&P 500 Returns. Retrieved from https://www.thestreet.com/investing/annual-sp-500-returns-in-history

- Dilworth, K. (2021, April 14) Average Credit Card Interest Rates: Week of April 14, 2021. Retrieved from https://www.creditcards.com/credit-card-news/rate-report/

- Gravier, E. (2021, March 10) Here’s the Average Interest Rate on Private and Federal Student Loans – Plust What to Look Out For. Retrieved from https://www.cnbc.com/select/average-interest-rate-on-private-and-federal-student-loans/

- Gravier, E. (2021, Jan 22) President Biden’s executive order extends federal student loan payment freeze for 8 months—what experts say borrowers should do. Retrieved from https://www.cnbc.com/select/biden-extending-federal-student-loans-freeze.

- N.A. (ND) 30-Year Fixed Mortgages Since 1971. Retrieved from http://www.freddiemac.com/pmms/pmms30.html.